Latest News

Value Investing Opportunity: Incyte Corp. (NASDAQ:INCY) Presents a Compelling Casechartmill.com

Via Chartmill · January 31, 2026

The data centers that support AI are increasingly being powered by clean energy.

Via The Motley Fool · January 31, 2026

A 10% owner in a leading energy company sold nearly 50 thousand insider shares towards the end of January 2026, and it's unclear if it's tied to the company struggling to recover from a rough 2025.

Via The Motley Fool · January 31, 2026

Zoetis Inc. (NYSE:ZTS): A Dependable Dividend Stock Built on Financial Strengthchartmill.com

Via Chartmill · January 31, 2026

Even a growth investor could benefit from owning this high-yield energy stock.

Via The Motley Fool · January 31, 2026

CF Industries Holdings Inc (NYSE:CF): A High-Quality Dividend Stock for Sustainable Incomechartmill.com

Via Chartmill · January 31, 2026

In this video, Jordan argues that the recent

Via Talk Markets · January 31, 2026

There's a lot for investors to like about Meta in 2026.

Via The Motley Fool · January 31, 2026

Nvidia shares could charge higher as artificial intelligence (AI) spending increases across data centers and autonomous vehicles.

Via The Motley Fool · January 31, 2026

These players are solid bets in both good and tougher market times.

Via The Motley Fool · January 31, 2026

Central banks from Washington to Frankfurt are telling us they're in a good place. And they have a point, even if that seems wildly at odds with gestures at everything going on in the world.

Via Talk Markets · January 31, 2026

Mag 7 earnings for Q4 2025 show a

Via Talk Markets · January 30, 2026

This insurance company helps cover its clients' properties against natural disasters, but its stock has been anything but a disaster.

Via The Motley Fool · January 31, 2026

Social Security's inflation-measuring yardstick continues to come up short for those who rely most on Social Security income.

Via The Motley Fool · January 31, 2026

TSMC founder Morris Chang ended a year-long public absence with a private Taipei dinner alongside Nvidia CEO Jensen Huang, reassuring the semiconductor industry of his sharpness and underscoring TSMC's continued central role as global chip capacity expands worldwide.

Via Benzinga · January 31, 2026

A lot can happen in five years.

Via The Motley Fool · January 31, 2026

Blue skies appear to be ahead for Apple -- with one pesky dark cloud.

Via The Motley Fool · January 31, 2026

It remains a compelling investment.

Via The Motley Fool · January 31, 2026

In January 2026, economists find that tariffs contributed ~1.1–1.4% to annual inflation. While median households face $1,400 in extra annual costs, the impact is less than feared due to implementation lags and exceptions.

Via Talk Markets · January 31, 2026

Lukoil has agreed to sell most of its international assets to Carlyle amid Western sanctions and competing bids.

Via Benzinga · January 31, 2026

While everyone is different, here's a snapshot of what to expect if you've saved roughly what the average boomer has.

Via The Motley Fool · January 31, 2026

If you're seeking exposure to the nuclear energy buildout without investing in uranium miners, this construction company is worth a look.

Via The Motley Fool · January 31, 2026

Amazon.com is asking the FCC for a two-year extension on its 1,600-satellite deployment deadline for its $10 billion Amazon Leo internet network, citing rocket shortages and launch delays, as it aims to catch up with SpaceX's Starlink while warning that denying the extension could slow U.S. broadband expansion.

Via Benzinga · January 31, 2026

Nvidia's proposed $100 billion investment in OpenAI has reportedly stalled as CEO Jensen Huang raises concerns over the AI startup's spending discipline and intensifying competition, prompting both companies to reconsider a smaller, nonbinding equity deal even as OpenAI attracts heavy Big Tech interest and posts surging revenue.

Via Benzinga · January 31, 2026

Rivian is making progress toward its big 2026 goal, but is it worth buying before that goal is hit?

Via The Motley Fool · January 31, 2026

LinkedIn co-founder Reid Hoffman urges Silicon Valley leaders to speak out against ICE killings, calling inaction unacceptable.

Via Benzinga · January 31, 2026

The CEO of a top mortgage lender sold over a million insider shares within a span of five days, but there's a catch to the sale.

Via The Motley Fool · January 31, 2026

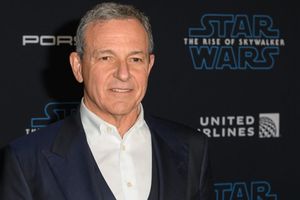

Walt Disney (NYSE: DIS) CEO Bob Iger has reportedly told associates he plans to step down and pull back from daily management before his contract expires on Dec. 31, and the entertainment giant's board is set to meet next week to vote on a successor.

Via Benzinga · January 31, 2026

The electric vertical takeoff and landing (eVTOL) market offers huge upside potential, but also downside risk.

Via The Motley Fool · January 31, 2026

The Vanguard Information Technology ETF is missing some key long-term pieces.

Via The Motley Fool · January 31, 2026

SaaS stocks have plunged on AI fears.

Via The Motley Fool · January 31, 2026

Eli Lilly CEO Dave Ricks said upcoming Medicare coverage of obesity drugs could be a game-changer for the launch of its experimental weight-loss pill orforglipron, potentially expanding access to millions of patients even as competition with Novo Nordisk intensifies ahead of both companies' earnings.

Via Benzinga · January 31, 2026

Trump taps veteran economist Brett Matsumoto to lead the Bureau of Labor Statistics (BLS) after abruptly firing the agency's commissioner in August.

Via Benzinga · January 31, 2026

Deckers continues to deliver solid growth even as Wall Street remains skeptical.

Via The Motley Fool · January 30, 2026

Blue Origin pauses New Shepard suborbital flights to focus on lunar lander development for NASA's Artemis program.

Via Benzinga · January 30, 2026

Today’s silver crash is a reminder that the market can remain irrational longer than you can remain solvent. Whether this is a temporary shock or the start of a deeper correction remains to be seen.

Via Talk Markets · January 30, 2026

A federal jury convicted former Google engineer Linwei Ding of stealing AI chip and supercomputer trade secrets to benefit China in the first U.S. AI economic espionage case, exposing him to decades in prison.

Via Benzinga · January 30, 2026

The U.S. Senate late Friday approved a bipartisan government funding package aimed at preventing a prolonged shutdown, but a brief lapse in funding now appears unavoidable as the House of Representatives is not expected to vote until Monday.

Via Benzinga · January 30, 2026

Johnson & Johnson is a picture of stability.

Via The Motley Fool · January 30, 2026

In this video, we dive into stock market trends, dissect key sector moves, and share actionable insights to help individual investors navigate volatile markets with confidence.

Via Talk Markets · January 30, 2026

Via Benzinga · January 30, 2026

The week's video is in Q & A format with a focus on issues weighing on the minds of investors in late January 2026

Via Talk Markets · January 30, 2026

Apple's revenue growth is accelerating again, while Meta's outlook is strong but clouded by heavy spending.

Via The Motley Fool · January 30, 2026

The stock's price has soared in 2026, but there's a glaring problem for investors.

Via The Motley Fool · January 30, 2026

SpaceX reportedly earned $8 billion on $15 billion to $16 billion in revenue last year as banks eye a $50 billion IPO at a valuation above $1.5 trillion.

Via Benzinga · January 30, 2026

EUR/USD drops during the North American session, down by 0.75% amid a session characterized by overall US Dollar strength, sponsored by Trump’s mild-hawkish pick to lead the Fed and an inflation report that warrants steady rates by the Fed.

Via Talk Markets · January 30, 2026

The flash storage leader's profits crushed Wall Street's expectations.

Via The Motley Fool · January 30, 2026

China has conditionally approved DeepSeek and other major tech firms to buy Nvidia's H200 chips, undercutting earlier fears that the low-cost AI startup would reduce demand for Nvidia's high-end processors.

Via Benzinga · January 30, 2026

The Producer Price Index (PPI) surged past expectations, signaling persistent inflationary pressure in the manufacturing sector. This unexpected spike complicates the Fed's

Via Talk Markets · January 30, 2026