News

Among the catalysts for Thursday are earnings from Kroger, Burlington Stores, BJ’s Wholesale, Costco and Marvell Technology.

Via Stocktwits · March 4, 2026

Nvidia has become the bellwether for the tech industry.

Via The Motley Fool · March 4, 2026

Investors looking for hidden gems should keep an eye on small-cap stocks because they’re frequently overlooked by Wall Street. Many opportunities exist in th...

Via StockStory · March 4, 2026

Explore how differing strategies and risk profiles set these two tech ETFs apart for investors seeking sector exposure.

Via The Motley Fool · March 4, 2026

Via Benzinga · March 4, 2026

What Happened? A number of stocks jumped in the afternoon session after a broad rally continued to suggest renewed investor interest in the sector. The move ...

Via StockStory · March 4, 2026

What Happened? Shares of video communications platform Zoom (NASDAQ:ZM) jumped 6.3% in the afternoon session after a broad rally continued to suggest renewed...

Via StockStory · March 4, 2026

Waste Connections (TSX:WCN) stock might be the best smart beta stock to buy on weakness right now.

Via The Motley Fool · March 4, 2026

Pepeto announces $7.5M raised and Crypto news is tracking a project that most people had not heard of three months

Via First Publisher · March 4, 2026

If you are fatigued with tech stocks, these income-generating sectors are outperforming in 2026.

Via Barchart.com · March 4, 2026

Bitcoin is leading risk assets higher in an impressive Wednesday rally.

Via The Motley Fool · March 4, 2026

The Federal Reserve said that overall economic activity increased at a ‘slight to moderate pace’.

Via Stocktwits · March 4, 2026

The financial landscape of 2026 is witnessing a profound shift in global capital as the "Emerging Markets Breakout" transitions from a technical signal to a full-blown market regime. For the first time in over fifteen years, the MSCI Emerging Markets Index has decisively cleared long-standing resistance levels, marking what analysts

Via MarketMinute · March 4, 2026

Earlier this week, the SEC blocked ETF companies from issuing highly leveraged ETFs. Here's what investors should know.

Via Barchart.com · March 4, 2026

LQD’s vast corporate bond reach and liquidity set it apart from SCHQ’s Treasury focus, shaping distinct risk and diversification profiles.

Via The Motley Fool · March 4, 2026

If you're worried about downside risk right now, here are two smart choices.

Via The Motley Fool · March 4, 2026

Digital asset markets experienced a seismic shift today, March 4, 2026, as Bitcoin (BTC) successfully reclaimed and held the $73,000 psychological threshold. The move has sent shockwaves through the equity markets, specifically targeting firms with direct exposure to the blockchain ecosystem. Investors, fueled by a mixture of institutional momentum

Via MarketMinute · March 4, 2026

Bitcoin climbed to $73,000 on Wednesday as strong ETF inflows and improving traditional market sentiment boosted broader crypto momentum.

Via Benzinga · March 4, 2026

Explore how LQD’s broader bond mix and TLT’s Treasury focus shape risk, yield, and diversification for fixed income portfolios.

Via The Motley Fool · March 4, 2026

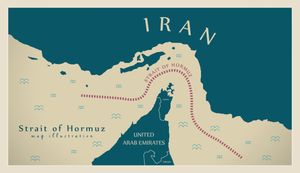

Is the Iran war a reason to change your investing strategy?

Via The Motley Fool · March 4, 2026

M.D. Sass launches its first ETF, the Concentrated Value ETF (SASS), seeding it with $70 million.

Via Benzinga · March 4, 2026

Bitcoin (CRYPTO: BTC) surged 7% in a single day move to $73,000, as heavy ETF inflows and improving technical structure combine to support price despite lingering macr

Via Benzinga · March 4, 2026

The iShares India 50 ETF hit a new 52-week low on Tuesday. While the impact of higher oil prices due to the Iran war hurts Indian companies more than most in Asia, this contrarian bet has historically been profitable.

Via Barchart.com · March 4, 2026

The original exchange-traded fund is still hugely popular.

Via The Motley Fool · March 4, 2026