Biopharmaceutical company Bristol Myers Squibb (NYSE:BMY) announced better-than-expected revenue in Q2 CY2025, but sales were flat year on year at $12.27 billion. The company’s full-year revenue guidance of $47 billion at the midpoint came in 1.6% above analysts’ estimates. Its non-GAAP profit of $1.46 per share was 32.6% above analysts’ consensus estimates.

Is now the time to buy Bristol-Myers Squibb? Find out by accessing our full research report, it’s free.

Bristol-Myers Squibb (BMY) Q2 CY2025 Highlights:

- Revenue: $12.27 billion vs analyst estimates of $11.38 billion (flat year on year, 7.8% beat)

- Adjusted EPS: $1.46 vs analyst estimates of $1.10 (32.6% beat)

- The company lifted its revenue guidance for the full year to $47 billion at the midpoint from $46.3 billion, a 1.5% increase

- Management lowered its full-year Adjusted EPS guidance to $6.50 at the midpoint, a 5.1% decrease

- Operating Margin: 14.5%, up from 12.8% in the same quarter last year

- Market Capitalization: $93.57 billion

Company Overview

With roots dating back to 1887 and a transformative merger in 1989 that gave the company its current name, Bristol-Myers Squibb (NYSE:BMY) discovers, develops, and markets prescription medications for serious diseases including cancer, blood disorders, immunological conditions, and cardiovascular diseases.

Revenue Growth

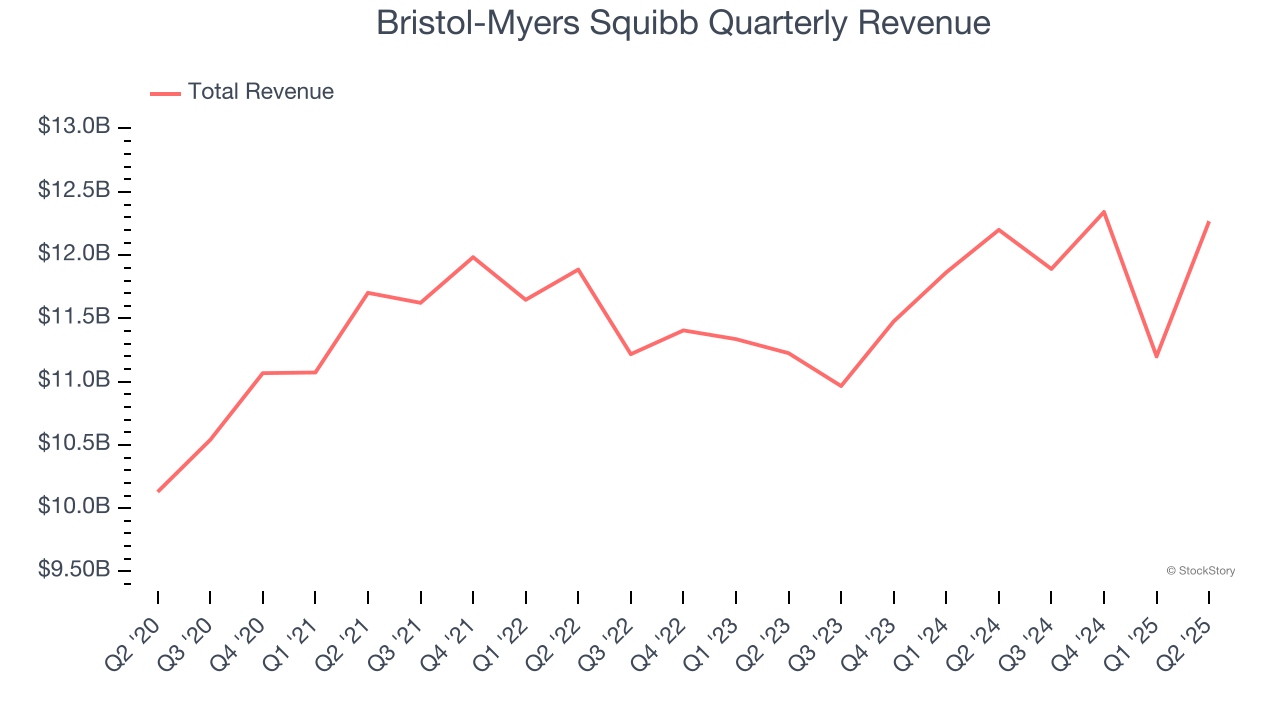

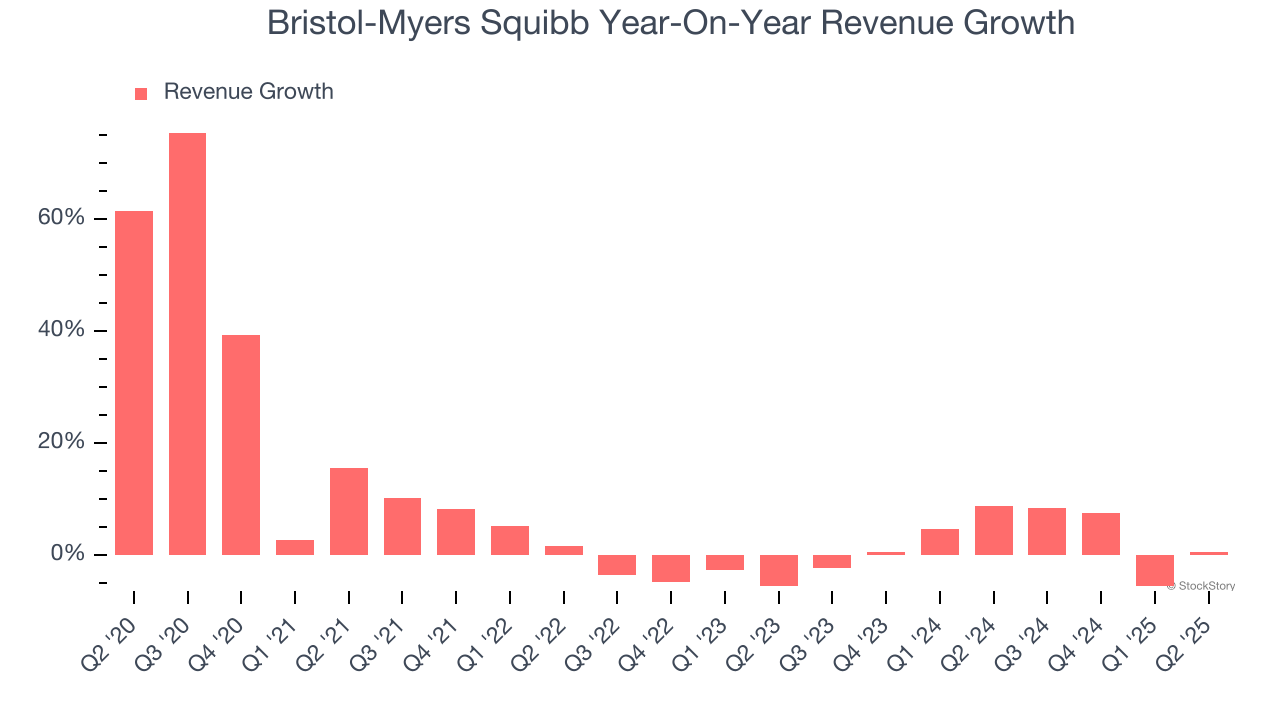

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Bristol-Myers Squibb’s sales grew at a mediocre 6.5% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Bristol-Myers Squibb’s recent performance shows its demand has slowed as its annualized revenue growth of 2.7% over the last two years was below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Growth Portfolio. Over the last two years, Bristol-Myers Squibb’s Growth Portfolio revenue averaged 17.4% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Bristol-Myers Squibb’s $12.27 billion of revenue was flat year on year but beat Wall Street’s estimates by 7.8%.

Looking ahead, sell-side analysts expect revenue to decline by 5.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

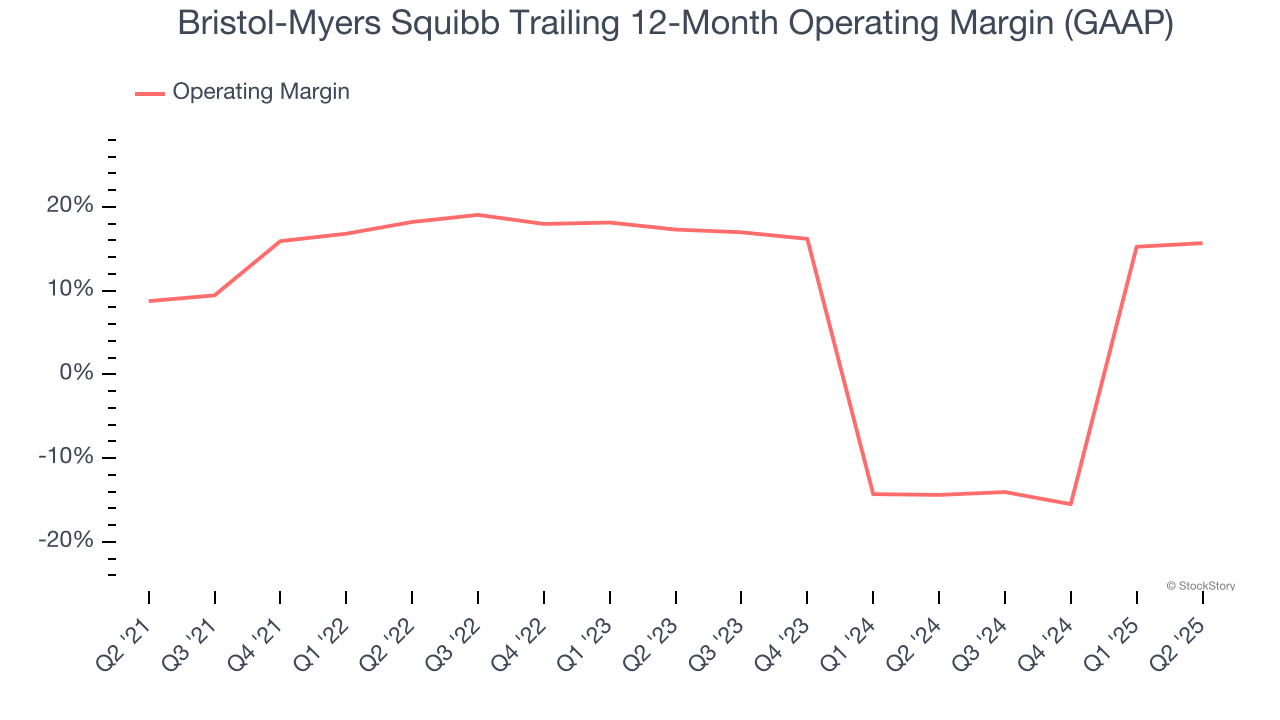

Bristol-Myers Squibb was profitable over the last five years but held back by its large cost base. Its average operating margin of 9.1% was weak for a healthcare business.

On the plus side, Bristol-Myers Squibb’s operating margin rose by 6.9 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming into its more recent performance, however, we can see the company’s margin has decreased by 1.6 percentage points on a two-year basis. If Bristol-Myers Squibb wants to pass our bar, it must prove it can expand its profitability consistently.

In Q2, Bristol-Myers Squibb generated an operating margin profit margin of 14.5%, up 1.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

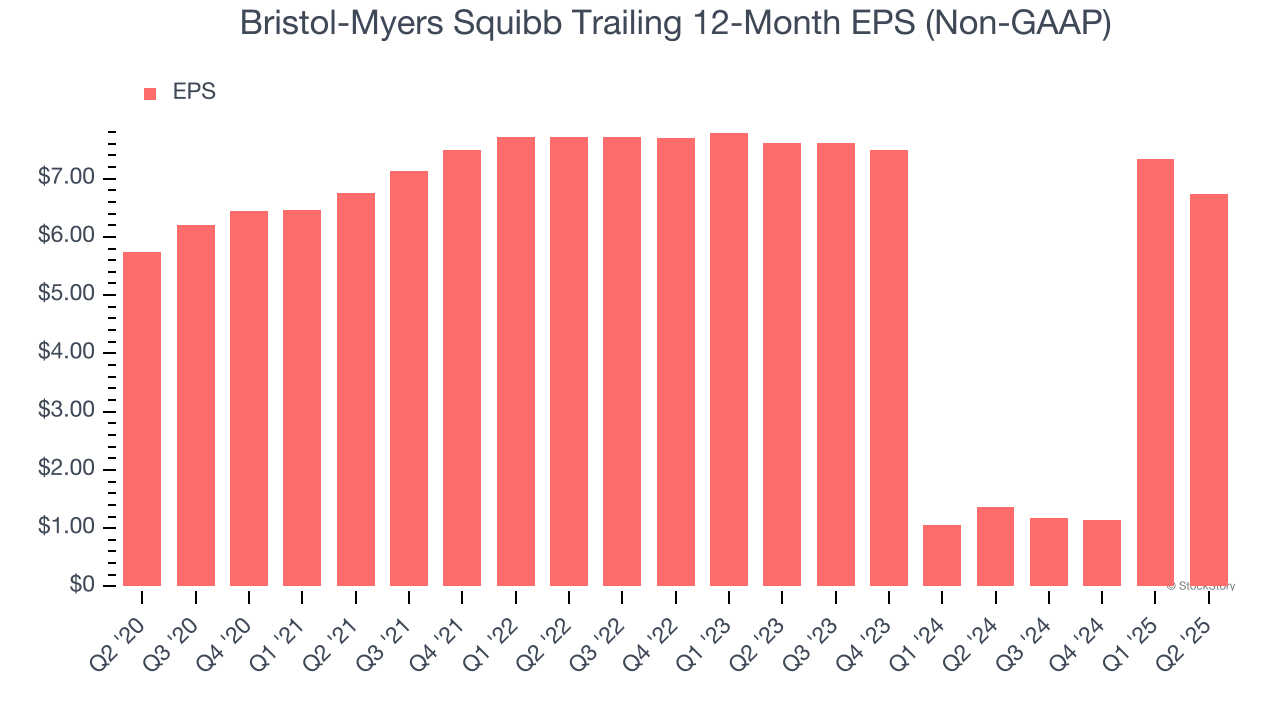

Bristol-Myers Squibb’s EPS grew at an unimpressive 3.2% compounded annual growth rate over the last five years, lower than its 6.5% annualized revenue growth. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

In Q2, Bristol-Myers Squibb reported adjusted EPS at $1.46, down from $2.07 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Bristol-Myers Squibb’s full-year EPS of $6.73 to shrink by 5%.

Key Takeaways from Bristol-Myers Squibb’s Q2 Results

We were impressed by how significantly Bristol-Myers Squibb blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, full-year EPS guidance was lowered. Zooming out, we think this was a mixed print. The market seemed to be hoping for more, and the stock traded down 3.9% to $44.21 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.