Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Booking (NASDAQ:BKNG) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 50 consumer internet stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 27.7% since the latest earnings results.

Booking (NASDAQ:BKNG)

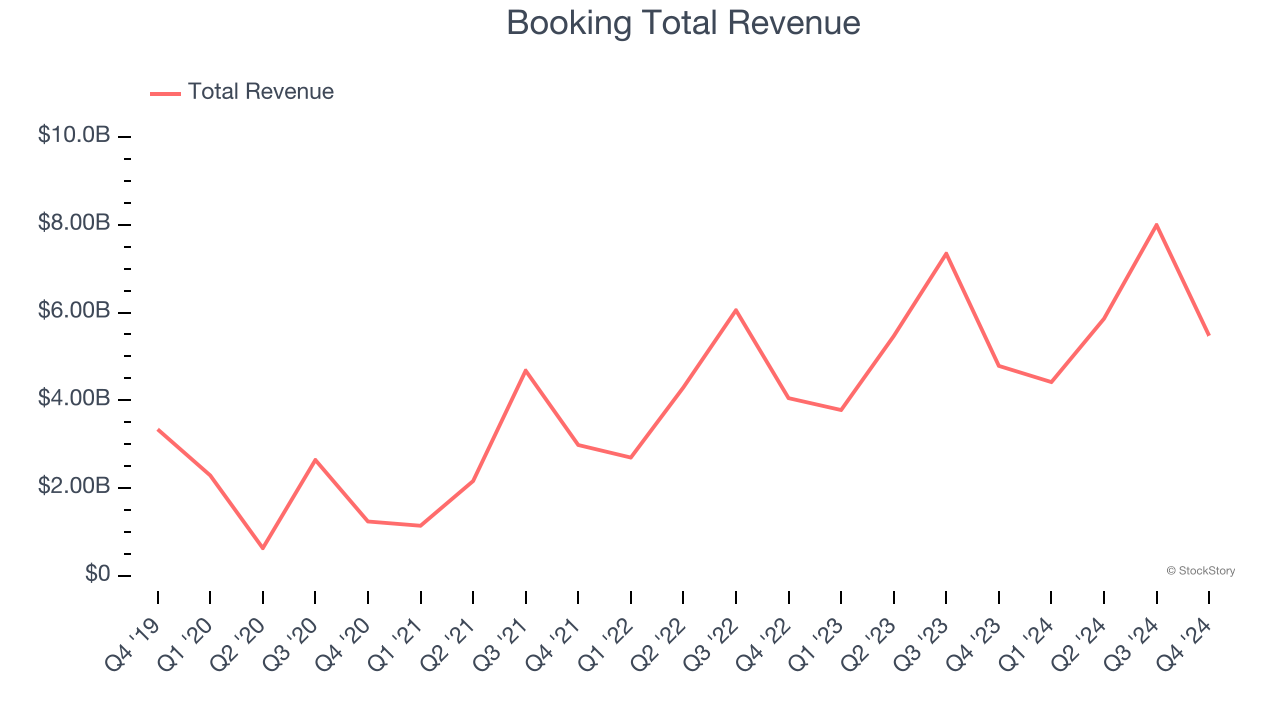

Formerly known as The Priceline Group, Booking Holdings (NASDAQ:BKNG) is the world’s largest online travel agency.

Booking reported revenues of $5.47 billion, up 14.4% year on year. This print exceeded analysts’ expectations by 5.4%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EBITDA estimates.

The stock is down 17.5% since reporting and currently trades at $4,143.

We think Booking is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q4: Carvana (NYSE:CVNA)

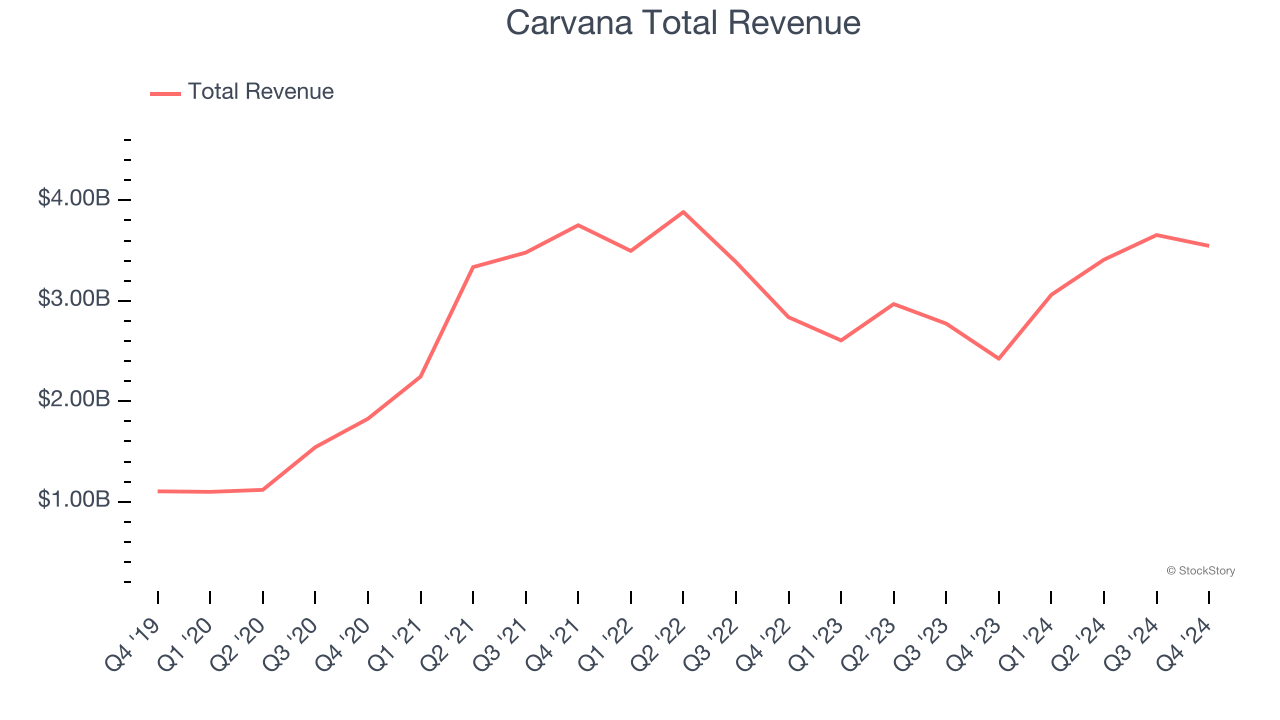

Known for its glass tower car vending machines, Carvana (NYSE:CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $3.55 billion, up 46.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

The stock is down 35.9% since reporting. It currently trades at $180.70.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $20.37 million, down 34.5% year on year, falling short of analysts’ expectations by 18.7%. It was a disappointing quarter as it posted a decline in its users.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 110,000 monthly active users, down 19.7% year on year. As expected, the stock is down 30.4% since the results and currently trades at $3.55.

Read our full analysis of Skillz’s results here.

Netflix (NASDAQ:NFLX)

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Netflix reported revenues of $10.25 billion, up 16% year on year. This print surpassed analysts’ expectations by 1.1%. Zooming out, it was a slower quarter as it recorded EPS guidance for next quarter missing analysts’ expectations.

The company reported 301.6 million users, up 15.9% year on year. The stock is flat since reporting and currently trades at $867.84.

Read our full, actionable report on Netflix here, it’s free.

Robinhood (NASDAQ:HOOD)

With a mission to democratize finance, Robinhood (NASDAQ:HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Robinhood reported revenues of $1.01 billion, up 115% year on year. This number topped analysts’ expectations by 7.7%. Overall, it was an exceptional quarter as it also produced a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ number of funded customers estimates.

The company reported 25.2 million users, up 7.7% year on year. The stock is down 37.7% since reporting and currently trades at $34.86.

Read our full, actionable report on Robinhood here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.