The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Remitly (NASDAQ:RELY) and the rest of the consumer internet stocks fared in Q3.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 50 consumer internet stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Luckily, consumer internet stocks have performed well with share prices up 15.2% on average since the latest earnings results.

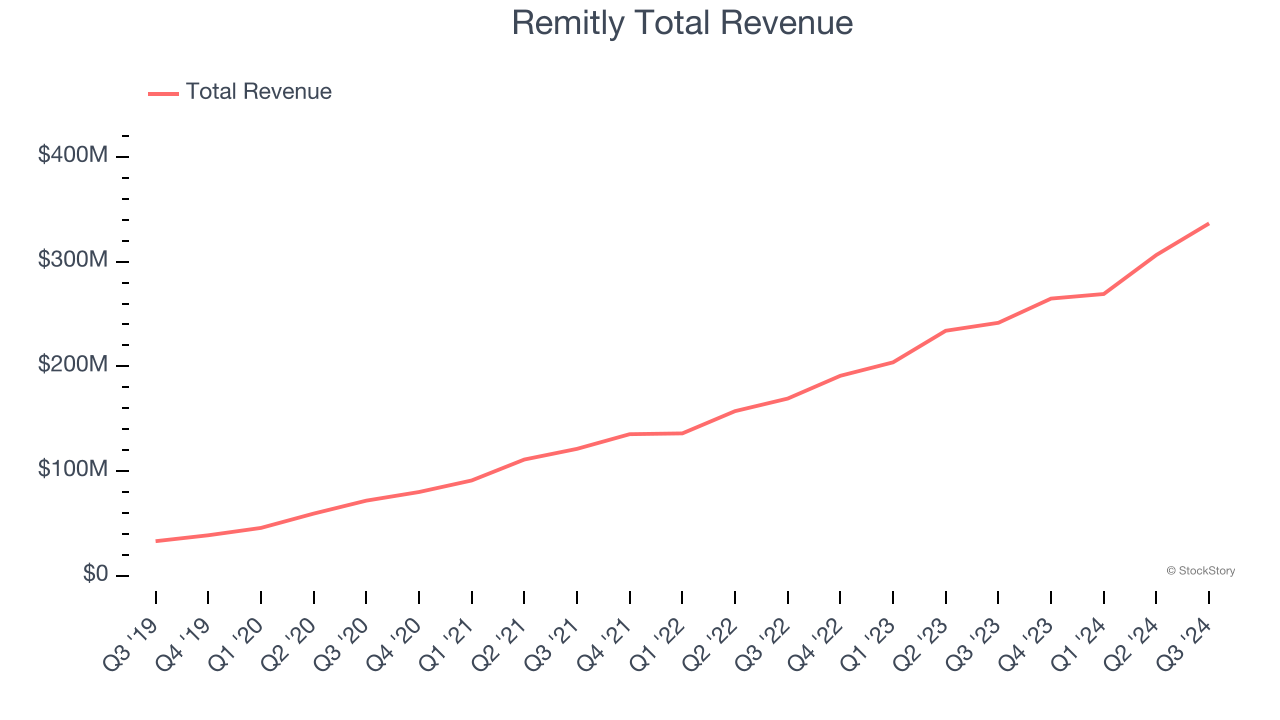

Remitly (NASDAQ:RELY)

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ:RELY) is an online platform that enables consumers to safely and quickly send money globally.

Remitly reported revenues of $336.5 million, up 39.3% year on year. This print exceeded analysts’ expectations by 5%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EBITDA estimates.

“I am grateful to our customers and global teams for the exceptional third quarter results,” said Matt Oppenheimer, co-founder and Chief Executive Officer, Remitly.

Interestingly, the stock is up 50.8% since reporting and currently trades at $23.01.

Is now the time to buy Remitly? Access our full analysis of the earnings results here, it’s free.

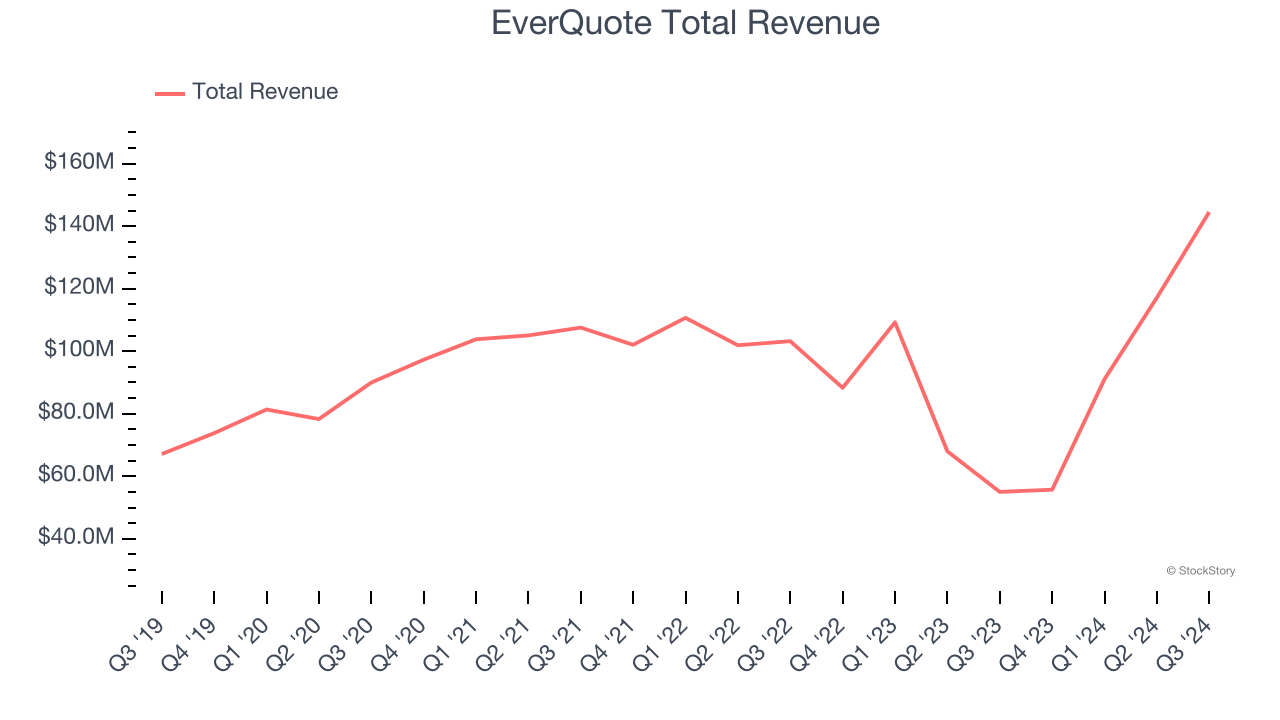

Best Q3: EverQuote (NASDAQ:EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $144.5 million, up 163% year on year, outperforming analysts’ expectations by 3%. The business had a stunning quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

EverQuote scored the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 16.7% since reporting. It currently trades at $20.23.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $24.56 million, down 32.6% year on year, falling short of analysts’ expectations by 7.9%. It was a disappointing quarter as it posted a decline in its users.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 121,000 monthly active users, down 28% year on year. As expected, the stock is down 11.3% since the results and currently trades at $5.

Read our full analysis of Skillz’s results here.

Alphabet (NASDAQ:GOOGL)

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ:GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

Alphabet reported revenues of $88.27 billion, up 15.1% year on year. This print topped analysts’ expectations by 2.4%. Overall, it was an exceptional quarter as it also put up a solid beat of analysts’ operating income estimates.

Reddit (NYSE:RDDT)

Founded in 2005 by two University of Virginia roommates, Reddit (NYSE:RDDT) facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

Reddit reported revenues of $348.4 million, up 67.9% year on year. This result surpassed analysts’ expectations by 10.6%. It was an exceptional quarter as it also recorded EBITDA guidance for next quarter exceeding analysts’ expectations.

Reddit achieved the biggest analyst estimates beat among its peers. The company reported 48.2 million daily active users, up 50.6% year on year. The stock is up 116% since reporting and currently trades at $176.55.

Read our full, actionable report on Reddit here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.