Latest News

The Economics of Investor Confidence: Why Venture-Backed Startups Still Print Pitch Decks

Silicon Valley is fueled by digital ingenuity, but the founders of tech companies have been known to walk into offices on Sand Hill Road with printed pitch decks. Outsiders are baffled by this contradiction, but venture capitalists know something fundamental about human psychology and decision making. Physical materials are processed by the brain differently than [...]

Via Visibility · January 21, 2026

The healthcare giant has had trouble winning over investors in the past year despite an incredibly low valuation.

Via The Motley Fool · January 22, 2026

The largest cruise line is hot again, and 2026 could be even hotter.

Via The Motley Fool · January 22, 2026

Alphabet's stock crushed the market in 2026.

Via The Motley Fool · January 22, 2026

SOUTHWEST AIRLINES CO (NYSE:LUV) Shows Strong Technical Setup for Potential Breakoutchartmill.com

Via Chartmill · January 22, 2026

ONESPAN INC (NASDAQ:OSPN): A Peter Lynch GARP Investment Case Studychartmill.com

Via Chartmill · January 22, 2026

Arista Networks Inc. (NYSE:ANET) Presents a Compelling Mix of Strong Fundamentals and Technical Breakout Potentialchartmill.com

Via Chartmill · January 22, 2026

ServiceNow Inc (NYSE:NOW) Embodies Quality Investing Principles in Caviar Cruise Screenchartmill.com

Via Chartmill · January 22, 2026

You won't have to wait too much longer.

Via The Motley Fool · January 22, 2026

ASML's stock price got a nice shot in the arm following TSMC's latest quarterly report.

Via The Motley Fool · January 22, 2026

These stocks offer impressive long-term upside with downside protection.

Via The Motley Fool · January 22, 2026

Taiwan Semiconductor has raised its growth projections.

Via The Motley Fool · January 22, 2026

Rollins Inc. (NYSE:ROL) Embodies Quality Investing Principleschartmill.com

Via Chartmill · January 22, 2026

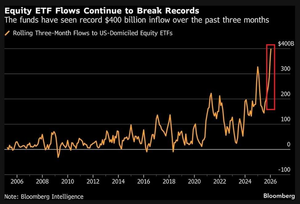

Western investors are not rushing to buy gold, but are mainly focusing on passive investments.

Via Talk Markets · January 22, 2026

The company disclosed that the Food and Drug Administration (FDA) has reviewed and authorized the use of its first commercially produced batch of the GP2 drug product in the ongoing FLAMINGO-01 trial.

Via Stocktwits · January 22, 2026

Their dividend streaks speak volumes.

Via The Motley Fool · January 22, 2026

Last week, during its Investor Day, Ondas raised its 2026 revenue outlook to a range of $170 million to $180 million, 25% above its previous $140 million target.

Via Stocktwits · January 22, 2026

Corvus increased its public stock offering to $175 million from $150 million, making 7.9 million shares of its common stock available for purchase at Wednesday’s closing price of $22.15.

Via Stocktwits · January 22, 2026

Global stock markets appeared poised to extend their recent rally after President Donald Trump softened his stance on imposing tariffs on Europe.

Via Talk Markets · January 22, 2026

The Vanguard Growth ETF has a stellar track record against the S&P 500 thanks to its unique portfolio.

Via The Motley Fool · January 22, 2026

Apple stated that being forced to comply with the Competition Commission of India’s demands for its financial records would defeat the company’s primary challenge against the penalty rules.

Via Stocktwits · January 22, 2026

Cosmic rays from supernovas will help secure the supply of crucial minerals.

Via The Motley Fool · January 22, 2026

Jason Calacanis, a prominent Silicon Valley investor, just dropped a bombshell on Tesla's next-generation artificial intelligence (AI) products.

Via The Motley Fool · January 22, 2026

Strategic decisions require human judgment on capital-labor tradeoffs, future flexibility, and safety standards—areas where AI provides data but humans drive choices.

Via Talk Markets · January 22, 2026

You may not want to retire just yet if you don't have other income to access.

Via The Motley Fool · January 22, 2026